Effective vendor management is a critical component of achieving budget optimization within any organization. By implementing robust processes and strategies, businesses can leveraging the value they derive from their vendors while minimizing costs. This involves meticulously choosing suitable vendors based on factors such as track record, negotiating favorable contracts, and continuously monitoring vendor output. A well-structured vendor management program can remarkably improve financial savings by reducing unnecessary expenses and streamlining resource allocation.

- Additionally, effective vendor management can promote stronger relationships with key partners, leading to enhanced collaboration and innovation.

- In essence, mastering vendor management is an essential strategy for any organization dedicated to financial sustainability.

Streamlining Cash Flow Through Effective Vendor Relations

Cultivating strong vendor connections is key to streamlining your cash flow. By fostering openness in communication and establishing mutually favorable agreements, you can optimize payment structures. A collaborative approach with vendors can lead to enhanced effectiveness, resulting in smoother operations and a more stable cash flow.

- Regularly assess vendor service to ensure they are meeting your needs.

- Negotiate invoice terms that favor both parties.

- Utilize technology solutions to automate payment processes and reduce administrative costs.

Effective Vendor Management: Budget Control Strategies

To maintain a healthy budget, implementing strong vendor management practices is essential. Initiate by clearly defining your procurement needs. Create a comprehensive RFP process that outlines your expectations and criteria for vendors. Conduct thorough vendor evaluations to select reputable partners who offer competitive pricing and high-quality services. Implement clear contractual agreements that specify payment terms, performance expectations, and dispute resolution processes. Regularly track vendor performance and modify your relationships as needed to ensure cost-effectiveness and value for your investments.

- Negotiate contracts that ensure favorable pricing and payment terms.

- Leverage your purchasing power by pooling purchases with other departments or organizations.

- Automate procurement processes to minimize administrative costs and improve efficiency.

Unlocking Value with Strategic Vendor Selection and Negotiation

In today's dynamic business landscape, more info leveraging value from vendor relationships is paramount. A strategic approach to vendor selection and negotiation can substantially influence a company's bottom line. By executing thorough due diligence, precisely defining expectations, and engaging in collaborative negotiations, organizations can secure the best possible deals. A comprehensive vendor network allows for optimal matching based on specific project goals.

- Leveraging

- Developing strong relationships with key vendor contacts fosters transparency, which is crucial for mutuallyadvantageous outcomes. }

- Regularly

Effect of Vendor Performance on Cash Flow Projections

Vendor efficacy can significantly influence the accuracy of cash flow projections. When vendors consistently deliver goods and services on time, businesses can confidently predict their expenses. Conversely, poor vendor compliance can lead to delays, unexpected costs, and inaccurate financial forecasting. To mitigate challenges, businesses should establish robust vendor management strategies that include regular performance assessments.

Building a Resilient Financial Framework: Vendor Management & Budget Alignment

A robust financial framework is essential for any organization's prosperity. Central to this framework are two key components: effective vendor management and strategic budget alignment. By meticulously selecting and managing vendors, organizations can maximize value and minimize risks. Simultaneously, aligning budgets with organizational goals ensures resources are utilized efficiently to drive growth and success.

- Implementing robust vendor selection criteria helps identify partners who match with your organization's values and needs.

- Regular performance evaluations and contract reviews are essential to maintain a high standard of service.

- Aligning budgets with strategic objectives allows for prioritization on initiatives that support the organization's overall mission.

This integrated approach to vendor management and budget alignment fosters a resilient financial framework, enabling organizations to navigate challenges and achieve sustainable growth.

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Jeremy Miller Then & Now!

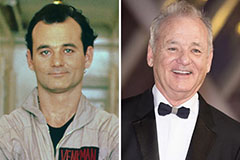

Jeremy Miller Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!